We have exciting news! Target just launched Cartwheel, a free savings program! Cartwheel is similar to shopping apps, like Ibotta, in that the offers can be combined with other coupons. It is an awesome new way to save on stuff you alresdy buy. Not to mention it is super easy!

The Target site states: “Together with Facebook, Cartwheel lets you connect with friends to share your favorite deals plus save money on the products you love.” That sounds good to me!

Here are the basics on the program.

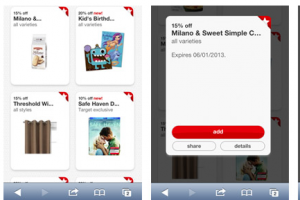

- The program may be accessed at cartwheel.target.com with a smartphone, tablet or computer. A Facebook account is required.

- Offers are easy to add: just click on the image and you’re done!

- To redeem a Cartwheel offer, either present a printed copy of your Cartwheel barcode or show it on a mobile device at checkout. It only needs to be scanned once because all offers connect to the same barcode.

- Offers are valid in U.S. Target stores only.

- After signing up, a user automatically gets to add up to ten offers. “Unlock badges” to access more.

- You will unlock badges for doing tasks, claiming offers and more!

Sign up now and check back here for hot deals using Cartwheel!